Our Mission

COOPEDUC will establish competitive financial services and products with the support of technological structures and processes of quality for the benefit of its affiliates and the community

Our Vision

Be a world-class cooperative supported with online technology

Specific and General Objectives

GENERAL OBJECTIVES

SPECIFIC OBJECTIVES

To try loans of aid to the Affiliated with reasonable interests.

To propose the foresight and the economic improvement, by means of the regular savings.

To fight usury, using itself the cooperation.

To guide the affiliated with respect to the refinancing of debts and to the establishment of reasonable payment plans.

To stimulate, to promote and to develop the initiative spirit, work, cooperation, friendship and solidarity between the affiliated, so that it is contributed to increase the national property.

To guard that the affiliated, directives and working maintain a respectful behavior of the set of moral norms that constitute the ethics of the Cooperative.

To protect the affiliated against the unemployment, diseases and other similar difficulties.

To teach respect for the affiliated by their all financial commitments.

To prepare the affiliated, directives, workers, and public in general in the enterprise management and other subject.

To provide different services of banking type and to increase savings and Credit activities which are considered necessary for the accomplishment of the objectives of the Cooperative.

To contract surety of fidelity, insurances of loans and saving and that would be able to the objectives of the Cooperative.

To negotiate and to permits credits, when it considers advisable, through the banks there are in the country, just as with the foreign financial organizations with the due approval of the Assembly by Delegates.

To establish the credit policy and its regulation; to consider that the interest that receives the loans is right, reasonable and competitive, in order to constitute a real and effective stimulus for the Affiliated.

To assume all the forms of liabilities and to emit obligations that will subscribe the affiliated, according to the conditions that the respective regulation established.

Historical Review

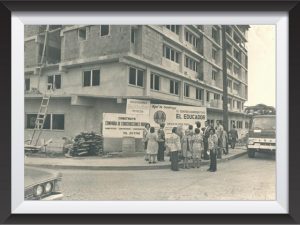

At the end of decade of the 50th, educators lived overwhelmed by the socioeconomic problem; the banks did not grant loans to the educators and there were few financial institutions. As a result, the educators were victims of usurers and speculators that charged the highest interest to get a loan and check cashing. Because of this, it started in our country, the development of a thought to get a cooperative, with this philosophy and many limitations, 28 associates organized la Cooperativa de Ahorro y Crédito El Educador R.L., in august 9th, 1958. With courage, COOPEDUC kept its development and growth. At the beginning only services of low credits occurred.

Review 60 years

In the decade of the 60s its development and progress was oriented by low credit services , savings , housing and education processes . In the next decade, he dabbled in housing projects such as the building Educator , today houses offices Headquarters , development of cooperative communities and encouraged the formation of other cooperatives educators.

Today

Nowadays, COOPEDUC is a socioeconomic company partner of great that might offers plenty of services of loans and savings to thousands of people, assurances, mortgage, financing of cars, seminars, solidarity plans, scholarships, and qualification in different areas; these are some of the services that you can find being associate of COOPEDUC.

COOPEDUC has raised a responsible scheme for the work focused in the planning and changes that have allowed it to stay in growth, in spite of the high level of competition of the banking sector and financial intermediation.